What is the Euribor?

The Euribor (Euro Interbank Offered Rate) is the interest rate at which banks in the eurozone lend money to each other over different periods of time (one week, one month, three months, six months and one year). This rate serves as a benchmark for many financial products, particularly for determining mortgage rates.

How is the Euriborcalculated?

To calculate the Euribor, the process starts with the interest rates reported daily to the European Money Markets Institute (EMMI) by a panel of leading banks in the eurozone (currently 18 financial institutions). The rates are calculated based on interbank transactions conducted by banks throughout the day, excluding the most extreme values (the top and bottom 15%) to derive a representative average that reflects the actual interest rate for bank-to-bank lending in the eurozone.

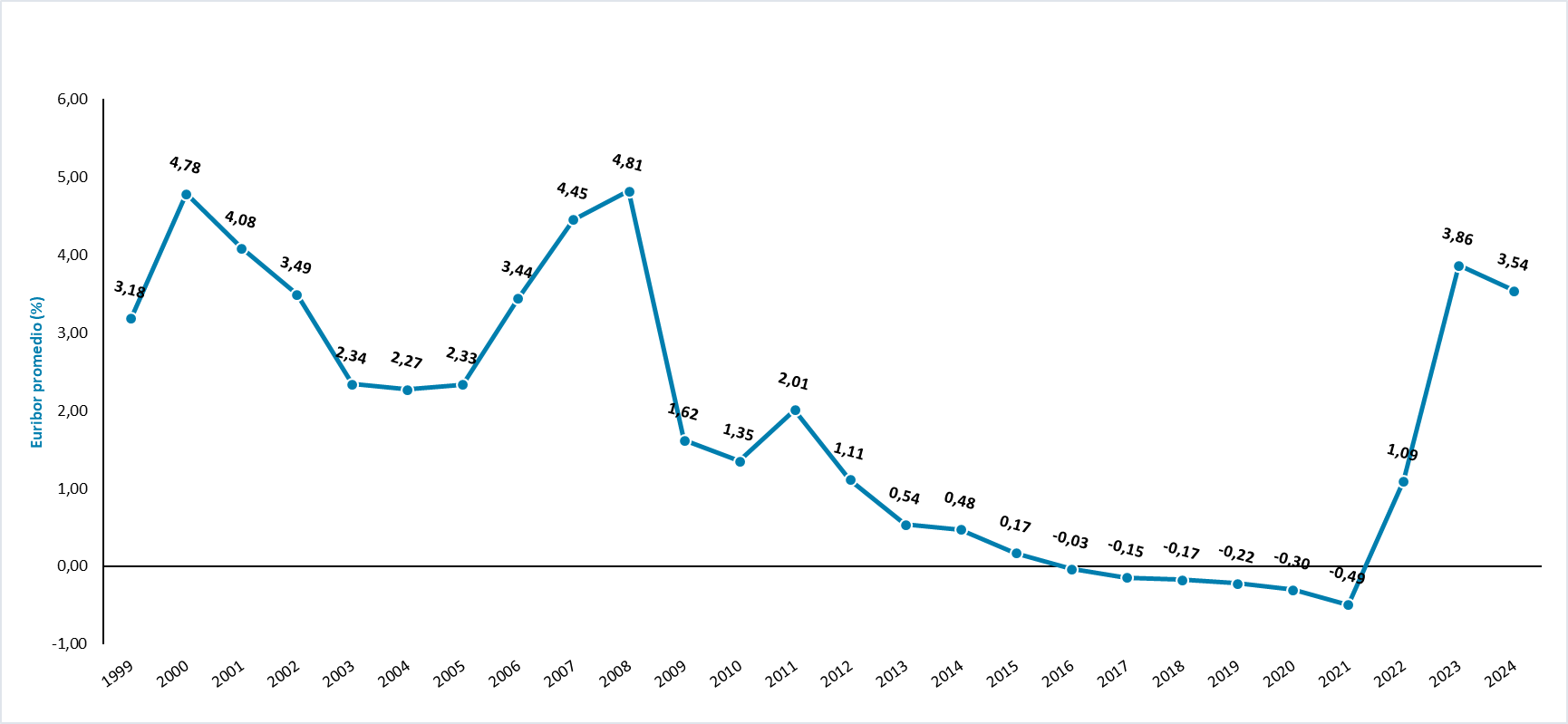

The Euribor is sensitive to the decisions of the European Central Bank (ECB). Between October 2023 and December 2024, the 12-month Euribor (12M) dropped from 4.1% to 2.4%, driven by declining inflation in the eurozone and the impact of the ECB's tighter monetary policies. Another example of the Euribor's sensitivity to ECB decisions was seen in January 2025, when it began to rise again, reaching 2.53%. This was driven by the return of inflation in the eurozone and increased pressure on the ECB to slow down interest rate cuts.

In a way, the 12M Euribor today reflects the average expected short-term rates, such as those of the ECB, over the next 12 months (plus a premium, which includes elements such as the expected counterparty risk, liquidity of the financial system or uncertainty regarding monetary policy).

Thus, the expectations of ECB rate increases or cuts translate into increases or reductions in the Euribor, and therefore into cheaper or more expensive loans to families and companies.

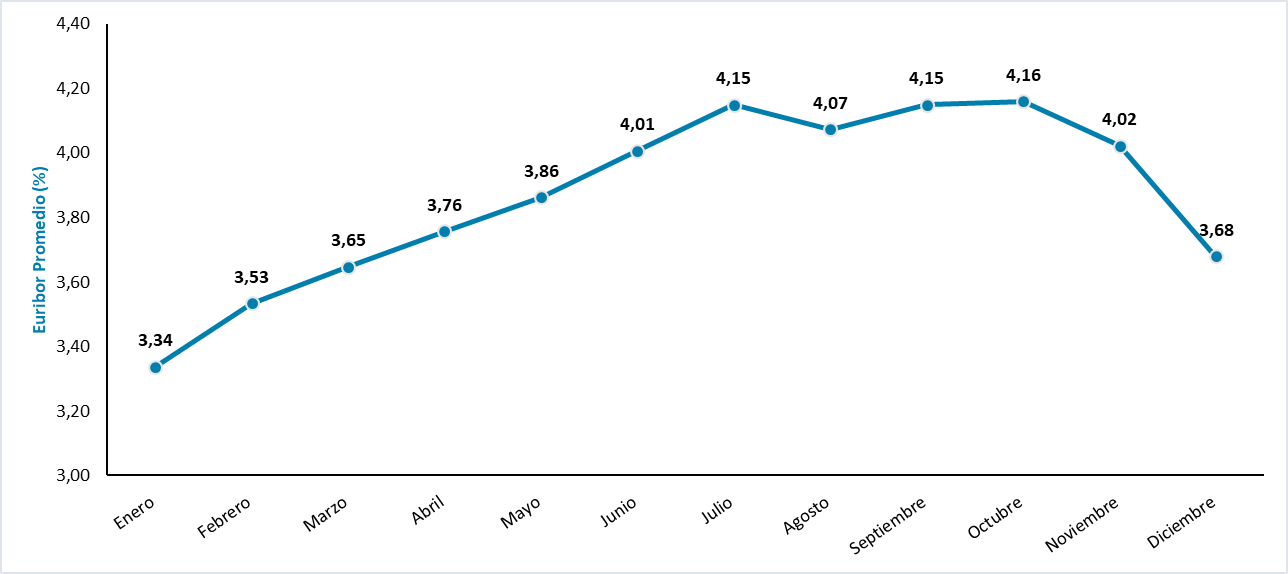

Value of the Euribor in 2024

In 2024, the Euribor continued the trend that began in 2023. Although there was a slight uptick in the first months of the year, reaching 3.72% in March, the rate ultimately declined, ending at 2.44% in December 2024. Therefore, the Euribor fluctuated between 4% and 2.5% throughout the year, marking a decline from the peak of nearly 4.2% at the end of 2023. This trend reflects the ECB's efforts to control inflation and cool down the economy.